There is a woman right now, somewhere in Chicago, who is in constant fear over her future financial security. She is concerned that she won’t be able to pay for her kids education, handle a medical catastrophe, and feels that she is likely to outlive her money. She is terrified that, before she knows it, she’ll be living in a Sub-Zero box underneath Lower Wacker Drive. However, today, she owns her own business and earns over $375,000 per year. Sound crazy? It shouldn’t.

The feelings of fear that women have about their future financial security is very real, no matter their current financial standing. From the average woman to Oprah, these concerns are experienced by all women. While women have made significant advances in society, which has led to increased financial status for many women, insecurities women feel over their financial futures has shifted dramatically and finance needs to take notice.

A measure of subjective well-being indicates that for many women happiness has declined, relative to men, despite recent economic advancements in work force participation and wealth. Financial security has been shown to be more predictive of life satisfaction than standard indicators of economic status, like income (Miron-Shatz, 2009). Women’s feelings on financial security have been found to predict life satisfaction even when measures of assets and income had already been accounted for.

There is something more going on than a woman’s job title, how much money she makes, and what she is able to buy. Research from the Spectrum Group shows that High Net Worth Women (HNW2) are not only more concerned than their male counterparts about maintaining their current financial position, they are also less confident about their job security, and retirement planning and more worried about personal economic issues, family challenges, and health problems. This would seem quite natural as women often feel greater emotional responsibility for their family, home, and community. It seems that not only do women feel less assured about their future financial status, but as they think about their futures, they are factoring in many more variables than their own personal financial status.

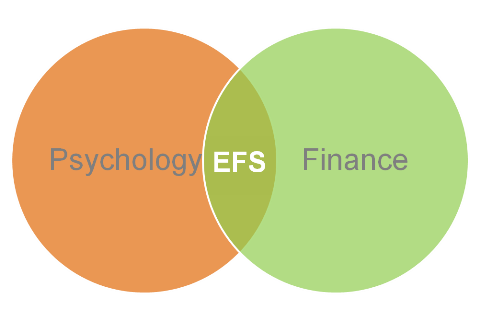

The concerns that women have about their financial security are very real and, often, deeply felt. However, psychology typically does not account for financial security when measuring life-satisfaction and well-being. Similarly, the financial industry does not account for emotional security when measuring how a woman feels about her money or portfolio. This is why DyMynd is focused on developing tools that can be used to effectively measure Emotional Financial Security (EFS). EFS is experienced by all women, including, surprisingly to some, High Net Worth Women all the way up to the JK Rowling’s and Oprah’s of the world.